We are continually optimising and improving our services and products for your benefit. We do this on the one hand by rendering our internal processes more efficient and on the other by offering optimum solutions to our clients.

Implementation of the SCoRE Standards

In parallel to ECMS the Eurosystem’s Advisory Group on Market Infrastructures for Securities and Collateral (AMI-SeCo) is working towards developing a Single Collateral Management Rulebook for Europe (SCoRE), which defines common rules for managing collateral.

The AMI-SeCo identified ten areas where further harmonisation was needed.

Two of them

- SCoRE Corporate Action (CA) Standards (SCoRE 2)

- SCoRE Billing Processes Standards (SCoRE 6)

are also of relevance for OeKB CSD and will be implemented by OeKB CSD.

The SCoRE CA Standards are intended to facilitate a consistent and timely implementation of harmonised business processes and workflows for the processing of CA and meeting events across AMI-SeCo markets.

OeKB CSD will implement the corresponding standards in accordance with the "Single Collateral Management Rulebook for Europe – Corporate Actions". This can be accessed under the following link:

Corporate Actions: Single Collateral Management Rulebook for Europe

The SCoRE Billing Processes Standards sets out a single set of rules for the transmission of billing information by post-trade service providers related to custody and collateral management, including the alignment of billing frequency and dates and using ISO 20022 messaging.

OeKB CSD will implement the corresponding standards in accordance with the "Single Collateral Management Rulebook for Europe – Billing Processes". This can be accessed under the following link:

Billing Processes: Single Collateral Management Rulebook for Europe

The implementation of the standards in the OeKB CSD is described below.

Standard 1: Harmonised business processes and workflows for corporate actions

Already implemented by OeKB CSD.

Regarding SWIFT communication in ISO 20022/ISO 15022 please refer to Standard 15

Standard 2: Provision of data necessary for calculating proceeds

Already implemented by OeKB CSD.

Standard 3: Consistency of information provided by issuer (I)CSDs, investor (I)CSDs and custodians

Already implemented by OeKB CSD.

Standard 4: Rounding rules

Rounding down (instead of commercial rounding) will be implemented by OeKB CSD with the Go Live of ECMS/SCoRE. For PCAL Events, booking of securities (partial removal) will be commercially rounded.

Standard 5: Negative cash flows

OeKB CSD will not accept securities (e.g. bonds) that could generate negative cash flows and hence be compliant with the Standard.

OeKB CSD will not support the processing of negative cash flows where floating interest rates result in a negative coupon amount. No payment will be performed.

Standard 6: Business day rule

For new issues only the following Business Day rules will be accepted by OeKB CSD with the Go Live of ECMS/SCoRE in accordance with the standard:

| Business Day Convention | Calculation Period | Post-Trade Process |

| Following | Adjusted | Pay the next business day |

| Following | Unadjusted | Pay the next business day |

| Modified Following | Adjusted | Pay the previous business day |

Business Day Convention “preceding” will not be supported any longer for new issued securities.

Old issues (issued before the Go Live of ECMS/SCoRE) will be grandfathered.

Standard 7: Securities amount data

Securities amount data should be defined in accordance with this standard. OeKB CSD has implemented plausibility checks. Issuers are encouraged to be compliant with this standard.

Standard 8: Payment time

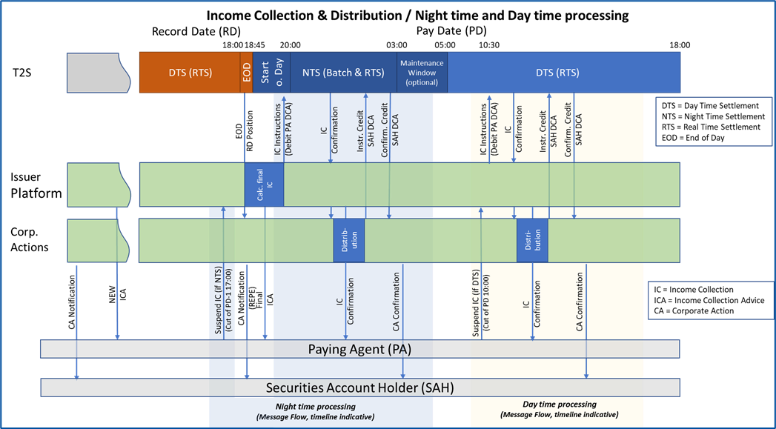

Night-time settlement (NTS) will be made available by OeKB CSD with the Go Live of ECMS/SCoRE to pay cash proceeds overnight. Issuers and their Paying Agents are invited to flag securities via Issuer Platform where payments such as dividends, coupon payments or redemptions should be processed in NTS.

The following figure gives an overview of Night-time versus Day-time settlement of cash proceeds.

NTS settlement for payment in securities will not be offered in a first step.

Standard 9: Notification of processing status

Will be implemented by OeKB CSD according to the standard with the Go Live of ECMS/SCoRE.

Standard 10: Elective events

Blocking of elected security position is already implemented according to T2S standards.

Standard 11: Availability of default options

Already implemented by OeKB CSD.

Standard 12: Handling of fees for meeting events

Not applicable because such events are unknown on the Austrian Capital Market.

Standard 13: Reversal of a corporate action

Will be implemented by OeKB CSD according to the standard with the Go Live of ECMS/SCoRE.

Standard 14: Processing of foreign currency payments

No change to the current process as OeKB CSD maintains customer’s Non-EUR cash accounts inhouse. Even if the workflow is different from the one described in the SCoRE Rulebook, OeKB CSD is compliant here.

Standard 15: ISO 20022 messages for corporate actions

Will be implemented by OeKB CSD according to the standard.

SRD II Meeting event and Shareholder Identification messages will continue to be exclusively in

ISO 20022 format.

For all other events customers may switch from ISO 15022 to ISO 20022.

If clients do not proactively switch to the ISO 20022 standard, ISO 15022 is being offered until further notice.

For further questions please contact

Service Center Asset Servicing

T +43 1 53127-2010

assetservicing@oekb-csd.at

Standard 1: ISO 20022 messages for billing information

With the Go Live of ECMS/SCoRE OeKB CSD will be able to provide billing information using an ISO 20022 (camt.077 ) message to ECMS (Eurosystem central banks). OeKB CSD has started to develop camt.077 billing messages on account level for all participants. As soon as these are available OeKB CSD will inform its participants.

Standard 2: Harmonised billing cycles

Already implemented by OeKB CSD.

Standard 3: Cut-off date for provision of billing information by (I)CSDs

Already implemented by OeKB CSD.

Standard 4: Harmonised dates for payment of fees to (I)CSDs

Already implemented by OeKB CSD.

For further questions please contact

Service Center Accounts & Settlement

T +43 1 53127-2020

settlement@oekb-csd.at