OeKB CSD provides a number of services as a member of the OeKB Group.

OeKB Group:

Among its four large business areas and its subsidiaries and partially owned companies the OeKB Group provides numerous services which foster economic growth and strengthen Austria as a market place in a globally competitive context.

The subsidiaries and partially owned companies include, among others, the CCP Austria Abwicklungsstelle für Börsengeschäfte GmbH (agent for stock-exchange transactions) and the OeKB CSD GmbH. Together with the OeKB department Capital Market Services, these three represent the capital market services of the OeKB Group.

Capital Market Services department of Oesterreichische Kontrollbank Aktiengesellschaft (OeKB):

As an independent institution, OeKB Capital Market Services offers central services for the Austrian capital market, and thus makes an important contribution to the success of the Austrian economy. Entrusted with a range of tasks by the Austrian legislator, they develop infrastructure services which deliver increased efficiency to all participants operating in the market.

As a central service provider in the capital market OeKB sees its role in strengthening Austria’s competitiveness in a global environment. The goal is to support the Austrian capital market and to strengthen Austria as an internationally renowned financial centre by offering economically relevant services.

More about the Capital Market Services of OeKB

CCP Austria Abwicklungsstelle für Börsengeschäfte GmbH as the central counterparty for stock-exchange transactions (CCP.A):

Nowadays, a modern capital market cannot survive without a central counterparty (CCP) for stock exchange transactions. In Austria, CCP.A on behalf of Wiener Börse AG ensures the clearing and risk management of all stock exchange transactions performed on the Vienna Stock Exchange.

CCP.A serves as a central contractual partner for all clearing members: It acts as counterparty in all transactions on the Vienna Stock Exchange and thus accepts the performance guarantee for all payments and deliveries connected with the transaction. Therefore, CCP.A functions, on the one hand as a buyer for all sellers, and on the other as a seller for all buyers.

As the central counterparty, CCP.A is responsible for the clearing and risk management of all CCP-eligible securities of Wiener Börse AG and assumes and manages the settlement and default risks. Its services:

OeKB CSD GmbH (OeKB CSD):

OeKB CSD is a 100% subsidiary of Oesterreichische Kontrollbank Aktiengesellschaft (OeKB).

It is a central securities depository (CSD) according to EU-CSD Regulation (Regulation (EU) No. 909/2014) and has several decades’ worth of experience in safekeeping, administration and settlement of securities.

With state-of-the-art settlement technology, OeKB CSD guarantees account holders and issuers efficient, cost-conscious services and offers them the advantages of an international network whilst taking account of local circumstances.

Its services:

- Securities Account Administration

- Cash Account Administration

- Settlement

- Asset Servicing

- Notary Services & Safekeeping

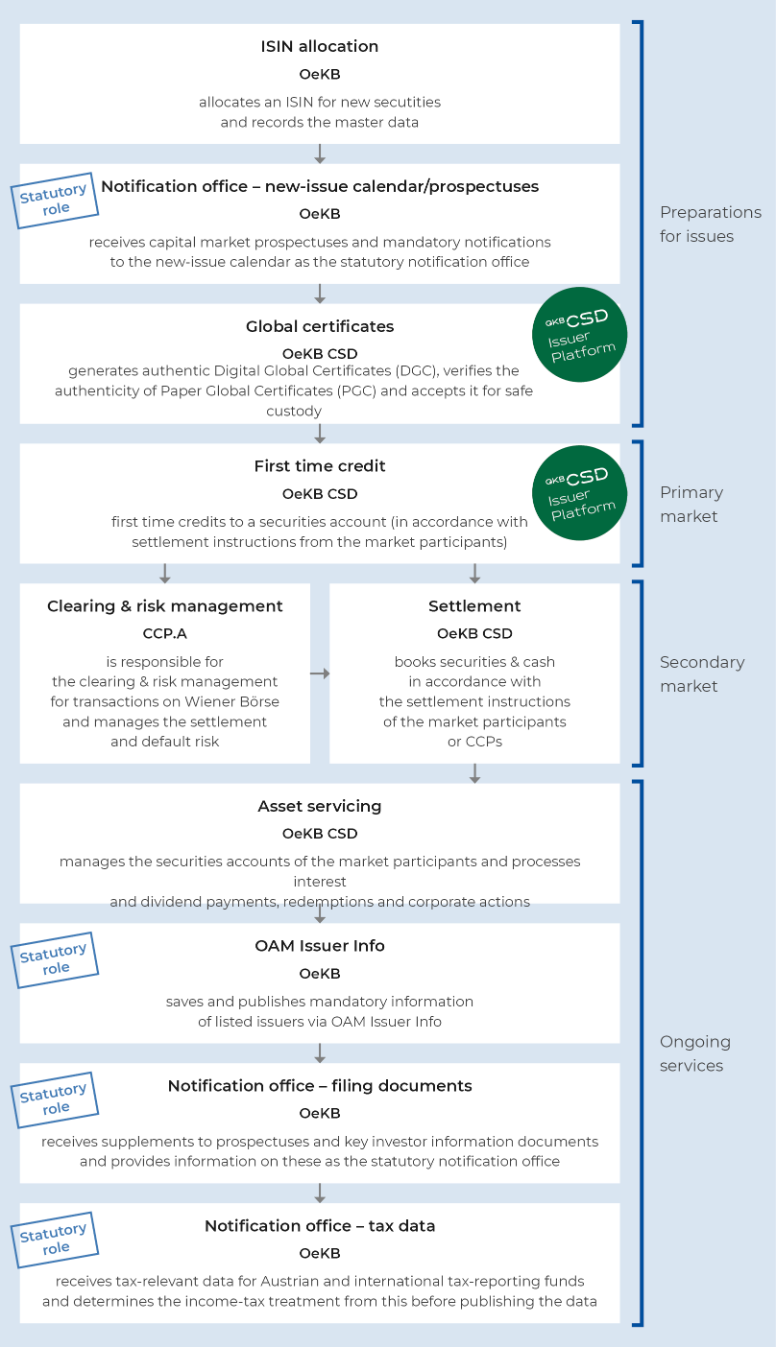

The OeKB Group in the Entire Life Cycle of a Security:

The OeKB Group plays an essential role in the entire life cycle of a security: